The Mounties may “always get their man,” according to the old adage, but they don’t always receive their First Nation tax exemption.

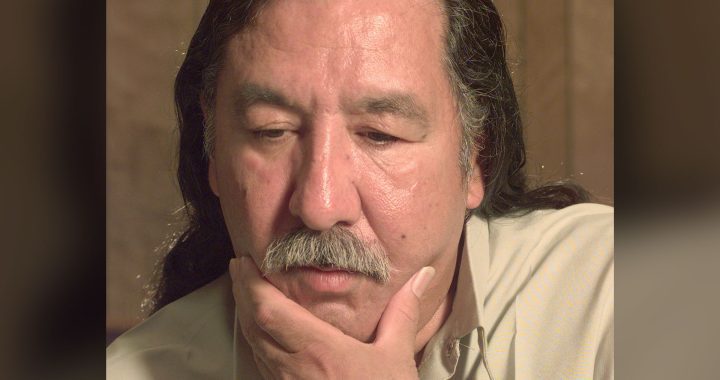

So says Chris Chanin, a retired Indigenous officer from B.C., who estimates the inconsistency has cost him thousands of dollars in lost pension income.

“The force doesn’t have clear policy that aligns itself with case law and rules that should apply to tax exemption for First Nations’ people,” said Chanin, who spent 18 years on the force.

“Their choice to just send it to Canada Revenue Agency (CRA) isn’t an appropriate choice.”

Chanin says he’s been shortchanged financially. And claims he can’t get anyone with the national police force to take his complaint seriously.

The frustration is evident in his voice when he says RCMP national pay operations (NPO) tells him “if there’s a concern go talk to Revenue Canada or your accountant about it.”

“They leave it up to members to sort out the problems themselves,” Chanin said in a telephone interview.

The RCMP, which tells APTN it had 1,479 Indigenous officers and 146 civilian employees in 2017, says it gives members a choice when it comes to claiming their First Nation’s tax-free status: Fill out a TD1-IN form supplied by CRA at the start of each year or claim it at the end of each tax year through their T4 tax slip.

“In either case, the eligible member receives the benefit – either throughout the year (via reduced taxes at source) or when they file their income taxes (via refund of taxes withheld),” RCMP spokesman Sgt. Harold Pfleiderer said in an e-mailed statement.

But Chanin disputes this.

He shared a lengthy email chain between him and payroll that shows the force replaced the CRA’s TD1-IN form with its own “unpublished policy” – an RCMP log sheet for calculating hours.

Chanin says the form used to have to be signed by an officer’s immediate supervisor before being reviewed by the Aboriginal Policing Section (APS) and then forwarded to NPO in Ottawa.

He says the form counted hours spent policing on a First Nation but didn’t reflect the officer’s tax-free status, applied exemptions or current case law.

“I believe the RCMP are not following a standard procedure for each First Nations member,” he said.

“Employees and managers contradict themselves and the unpublished 2006 APS policy regularly.”

Chanin says it took him a while to obtain the unpublished policy.

“No one’s pursued it this far,” he explained.

“I’m bringing it forward because members (are) told this is how it is or stonewalled, and after a while they probably give up.”

A spokesman for Revenue Canada says it’s up to individual employees to ensure they’re in the correct tax bracket. But it’s something their employer needs to be aware of, too.

“The employer is responsible for keeping the completed form TD1-IN to help determine if an employee’s employment income is exempt from income tax,” Etienne Biram said in an emailed statement from Ottawa.

“This form is not sent to the CRA, however the CRA may ask to review the form to verify whether the income earned qualifies to be exempt from income tax.”

The personal income tax exemption is part of the Indian Act: Section 87 “exempts from taxation the personal property of an Indian situated on a reserve.”

The courts have determined employment income is personal property.

And, as personal property, that puts the onus on employees to look after it, said an expert on First Nation taxation from BDO Canada.

“Nobody’s required to do this,” Jason Williams said in a telephone interview from his office in Thunder Bay, Ont.

“Effectively, this is a voluntary way of employers and employees coming together and saying, ‘OK, we think my income is exempt from income tax.’”

Williams said it’s a complex area that’s been the subject of hundreds of court challenges.

He said, to date, CRA has four criteria employees must meet, and its TD1-IN form is a tool to help them do that.

“I don’t think there’s any law saying (the employer) needs to do this,” he said.

“Ultimately, if an employer doesn’t withhold tax and CRA challenges it, the employer is not on the hook for that. CRA will always go after the employee for income tax.”

Williams said employers can be penalized for failing to withhold taxes but won’t have to repay them.

Chanin wonders why, then, the RCMP employs two levels of payroll staff in its Aboriginal Policing Section and National Pay Operations.

“The expectation is for members to know the rules and follow the rules yet that expectation isn’t there for their own staff to make sure they know the rules to have it processed,” he said.

Chanin wouldn’t make the figures public but says he suffered substantial losses on his pension.

And he doesn’t think he’s the only one.

“My goal is to reach out to all past and present RCMP First Nation members making them aware of the issues the RCMP are causing,” he added.

An NDP MP says the RCMP can – and should – do better for its members.

Matthew Dubé (Chambly—Borduas) said the move to “modernize and reform the culture of the RCMP” should include “reconciliation with Indigenous Peoples” inside and outside the force.

The RCMP is not the only police service facing this issue. The Nishnawbe-Aski Police Service (NAPS), which serves First Nations in northern Ontario, tells APTN it takes care of the tax exemption for its members.

Chanin said that would have saved him the “great personal expense” of hiring an accountant to “eventually get the RCMP to change their numbers.”

He said that’s not right for a force that exists to make people accountable to the law.

“At the end of the day, First Nation members…are at the whim of people in Ottawa handling their pensions who don’t know the current law,” he said.

“There’s no reason this should have to go to CRA because they (RCMP payroll) didn’t do their homework on it.”

Chanin said this lengthy experience has taught him the RCMP can police First Nations but doesn’t necessarily compensate members appropriately for doing so.