The Canadian Press

CALGARY _ The presidential permit for Keystone XL did little to assuage concerns Friday from the investment community that the project, which has stoked controversy since its inception nearly a decade ago, still faces a litany of challenges.

Beyond the political and corporate bravado that greeted the White House’s blessing, analysts took a more cautious view over whether TransCanada’s pipeline would ever get built.

“There’s still a number of hurdles,” said Justin Bouchard of Desjardins Capital Markets.

“I’m sure we’re going to see blockades like we saw with the Dakota Access Pipeline. … It’s certainly not a foregone conclusion that this thing will be built.”

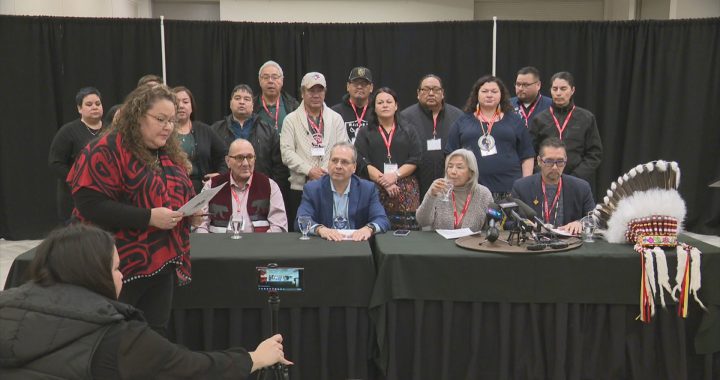

Environmentalists, First Nation and others opposed to the potential climate impacts fromt he 1,900-kilometre pipeline say they’ll keep trying to derail it through grassroots movements _ and they are warning the financial community directly.

“Investors should be very worried about the risky financials and lack of social licence attached to pipeline projects across both countries,” said Greenpeace campaigner Mike Hudema in a statement.

“The fight is far from over.”

Skirmishes could play out at the national, state and local levels as TransCanada works to put in place the final permits needed to start construction, with Nebraska the focal point of opposition.

A state commission is considering whether Keystone XL is in Nebraska’s interest, though its review is not taking into account safety risks.

TransCanada expects that process will conclude by the end of the year and construction to begin next year, with 2020 being the earliest that crude from Alberta’s oilsands could begin flowing in the pipeline.

Robert Kwan at RBC Capital Markets said the presidential permit was widely anticipated and he isn’t including Keystone XL in his valuation of TransCanada.

There’s also the question of economics. When Keystone XL was proposed, oil prices were far above US$100 a barrel, making the case for such a pipeline more attractive.

As the pace of oilsands growth slows, Keystone XL also faces increased competition from other proposed pipelines, including Kinder Morgan’s Trans Mountain expansion, the Enbridge Line 3 replacement and TransCanada’s own Energy East Pipeline, said Bouchard.

“Four or five years ago we needed all of those projects,” he said. “Today, it doesn’t seem like we do, just given there’s been massive curtailment in spending.”

Talk of challenges facing Keystone XL _ legal or political _ are not surprising, said Dirk Lever at AltaCorp Capital.

“They’ll do anything to stop it,” said Lever. “They just see a pipeline like an artery coming out of the oilsands, and they want the heart to stop.”

TransCanada’s stock on the Toronto Stock Exchange barely changed Friday, closing at $61.82, up six cents or 0.1 per cent.

Any questions from Ottawa?