John MurrayTricia and Verne Dano thought they were finally getting their home in the country.“We found a beautiful location southwest of Winnipeg about 150 kilometres. A beautiful brick home. It had everything we wanted,” Verne Dano said.But their bank told them they had a high debt-ratio, meaning they owed more than they owned and that would disqualify them for the new mortgage they needed.Then a telemarketing salesperson called Tricia. They wanted her to buy a new vehicle but Dano told them it was out of the question because she needed the mortgage.The salesman offered Dano what looked like a solution.“One of the sales persons called me from Birchwood Ford and said, ‘You should just consolidate. Consolidate. Come in. We’ll get you into another vehicle and we’ll consolidate your vehicle and you’ll have one payment which would be lower. The bank will like that,’” Dano said.It isn’t unusual for dealerships to call existing customers, but telemarketing to reach new customers is a relatively recent development.Even more recently social media has also become a platform for reaching out to potential customers – the industry has changed.Car sales ads are increasingly appearing on social media and for many this may seem like a good thing.Shopping online may also seem like a good way to avoid the face-to-face high pressure sales tactics.But it allows sales people to target very specific groups.APTN Investigates found many Facebook pages that target Indigenous people with names like Aboriginal Auto, Big Chief Motors, First Nations Financing and many others.

(Ten of the Facebook pages that APTN Investigates found using names with First Nations, Aboriginal or other similar names. Some have stereotypical caricatures and imagery.)

(Ten of the Facebook pages that APTN Investigates found using names with First Nations, Aboriginal or other similar names. Some have stereotypical caricatures and imagery.)

It’s a sales strategy called “affinity marketing.” The salesperson or retailer claims a connection – or affinity – to organizations or groups of people.George Iny is with the Automobile Protection Association (APA) in Montreal.“At its best affinity marketing means a community of people are entitled to either a lower price or access to a preferred level of service because they are a known group,” he said.The APA has been a car buyer’s advocate for almost 50 years.Some of these pages don’t have any clear indication of ownership or legitimacy.Others were found to be associated with mainstream dealerships but this wasn’t always obvious from their Facebook pages or websites.And some were clearly only interested in getting credit applications while others seemed entirely illegitimate.

(This screen capture is of a website that has no original content but is filled with what appears to be the default information included in a website template.)One, called First Nation Loans, didn’t actually create a website but just left the template content on it.

(This screen capture is of a website that has no original content but is filled with what appears to be the default information included in a website template.)One, called First Nation Loans, didn’t actually create a website but just left the template content on it.

Affinity marketing or just a name? Winnipeg’s Big Chief Motors is in the same location as Gauthier Chrysler, a local dealership.Gauthier Chrysler vice-president Kevin Schumacer said Big Chief Motors is a sub-prime retailer they share space with.

Watch how sub prime loans work.

Sub-prime retailing, or also called sub-prime financing is a method of lending aimed at consumers who may have some credit difficulties. Many loans are still offered by the same major banks but usually at a higher interest rates than what is often shown on many car sales ads.Nick Arora, manager of Big Chief Motors, said that he is Indian but not First Nations. To be clear, he means an Indian from India.He also said his business is not affinity marketing and the name was inspired by the beef jerky brand.

(Nick Arora of Big Chief Motors says the inspiration for his business name came from Big Chief Beef Jerky. An excerpt from Big Chief Meat Snacks’ website: “Although our heritage is European, the Indigenous people are credited as first inventing ‘jerky’ derived from the Quechua word ‘ch’arki’ which means dried, salted meat.” Photo: John Murray/APTN)

(Nick Arora of Big Chief Motors says the inspiration for his business name came from Big Chief Beef Jerky. An excerpt from Big Chief Meat Snacks’ website: “Although our heritage is European, the Indigenous people are credited as first inventing ‘jerky’ derived from the Quechua word ‘ch’arki’ which means dried, salted meat.” Photo: John Murray/APTN)

Arora agreed to an on camera interview but was not available for our broadcast deadline.Another company called Aboriginal Auto is registered to Birchwood Ford but there does not appear to be any Indigenous ownership in the company.We asked Birchwood Ford about Aboriginal Auto to which they replied by email.Birchwood said: “It is a business name we have used for over 15 years for marketing purposes.”Iny has a problem with that.“What you’re calling affinity marketing is something else. It’s basically what I see is appropriation perhaps of the identity or some kind of symbols that would suggest that maybe the person providing the service belongs to a particular community,” said Iny. “In fact it’s plain old sub-prime car retailing.”In addition to using sub-prime financing, lenders sometimes offer seven-year terms which may be attractive because of lower payments but some people will trade in their vehicles while still carrying a balance which then gets added into the new loan.Iny calls this the “upside-down consumer.”“You can stretch your loan out to 96 months at very low rates as long as you have good credit. In those cases all of these things allow you greater affordability and the vehicles are actually better. They last longer and they need less work than they did. However this does not extend to someone with shaky credit. In that case you have the illusion of affordability but what’s really happening is you’re being handcuffed for 96 months with deals running at very high rates,” he said.

The hidden camera investigation APTN Investigates visited Aboriginal Auto with a hidden camera.After walking around the lot without being approached our reporter went inside and asked where we could find Aboriginal Auto.

(APTN Investigates reporter approaches Aboriginal Auto as seen through the lens of the hidden camera.)

(APTN Investigates reporter approaches Aboriginal Auto as seen through the lens of the hidden camera.)

Without doing any shopping or looking at vehicles they immediately wanted to do a credit application.Birchwood general manager, Robyn Okaja, said in an email that this is their routine process as long as the customer agrees. She went on to say people are unlikely to walk on the lot these days.“Rarely, if ever, does a customer begin the purchase process in our dealership. It always starts on line,” she said.The same thing happened when we visited Big Chief Motors.Arora said, it often makes sense to get a credit application first because many customers don’t even know their own credit standing.Although getting a credit application first seemed unusual, as many experts recommend knowing your budget and what you are going to buy first, it is routine with these retailers.

(APTN Investigates follows Dan Roulette as he delivers a new vehicle to his customer in Peguis First Nation about 185 kilometres north of Winnipeg.)

(APTN Investigates follows Dan Roulette as he delivers a new vehicle to his customer in Peguis First Nation about 185 kilometres north of Winnipeg.)

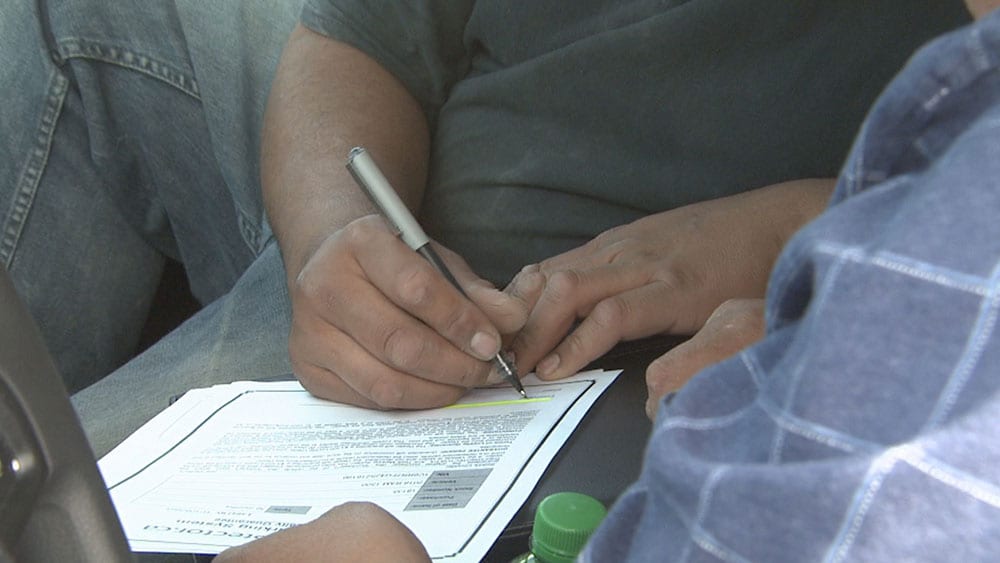

Delivery to a reserveDan Roulette, an Ojibwe man and a veteran car salesman often personally delivers vehicles to his customers.In fact, for registered Status Indians they must take delivery on a reserve in order to receive tax exemption.Roulette tells APTN the credit application is his usual first step.“Well for what I do, yes. Because unfortunately a lot of people I deal with have credit issues. When they do a credit application beforehand then we send in for a preapproval. At which time the bank will say well they’re approved for this kind of payment or this amount of money,” he said.We accompanied Roulette to Peguis First Nation where he delivered a brand new Dodge pickup to a young man.

(Dan Roulette sits in the truck he is delivering to Peguis First Nation. The young man who just bought the truck signs on the bottom line. PHOTO: APTN Investigates)

(Dan Roulette sits in the truck he is delivering to Peguis First Nation. The young man who just bought the truck signs on the bottom line. PHOTO: APTN Investigates)

The truck temporarily became Roulette’s office as they reviewed the documents and signed on the bottom line.Danos Make The DealWhen Tricia Dano met with the salesperson at Birchwood she was really focussed on getting a new home.In fact, that was most important to her and she felt she made it clear.“I expressed over and over and over again how important it was that it was a consolidation loan that the vehicles were going to be just one payment and that’s it,” she said.Then the call came in from Birchwood – they were approved.Now that the Danos had this deal they would have lower payments. It was a relief.They told the bank, who just needed the paperwork.Then a couple of weeks later Ford Credit, the lender whose loan was supposed to be consolidated into the new truck loan, called to say they had missed a payment.Dano called Birchwood and she says they said Ford was just waiting for paperwork.They continued with preparations for moving to the new home.“So yeah we were getting all of the unnecessary things out of the house and putting it into storage so that we could stage it for selling and that was just three days before,” said Tricia Dano.Then Verne Dano was driving to work and got a call.“I get Ford Credit calling me saying I’ve missed three payments,” he said.

(Tricia Dano removes the dealership branding from her truck. Dano says she likes the truck but she felt she just wasn’t treated fairly.)

(Tricia Dano removes the dealership branding from her truck. Dano says she likes the truck but she felt she just wasn’t treated fairly.)

A Sour Deal? “It was so cold and so shocking,” Dano said.The couple was on the hook for two payments after all and now they were three payments behind on one of the loans.Tricia called the bank and told them about the mix-up.“When I told him what happened he kind of just went silent. He just had this kind of noise. And he said, we can’t. There’s no way that we can pre-approve you,” she said.She immediately took her concern to the general manager of the dealership.After a series of sometimes terse emails they began phoning each other and trying to come to a resolution.Dano shared her experience on social media and her friends also posted about what happened.This didn’t go over well with the general manager who Dano says insisted those posts be deleted before any kind of resolution was discussed.APTN asked George Iny to look over the Dano’s agreement.There were other parts of the deal that were questionable, he said.He called it “a terrible deal for the buyer.”“So they take back your vehicle but the outstanding payment — that’s called The Upside Down Consumer. That person then has that added to the price of the next vehicle,” he said.Iny noted that it was unusual to have an aftermarket warranty with a brand new vehicle.He said compared to the factory warranty it would be limited in scope, less comprehensive, potentially more difficult to get service, and more expensive.And then there were the extras.There was $7,000 cash-back line in the document which is really a $7,000 loan included in the financing.Iny said the tire warranty and anti-theft etching were over-priced.“Never take nitrogen in your tires from a car dealer. You can get it for free or for five dollars a tire at many retailers,” Iny said.And the rust protection sold to the Danos wasn’t just overpriced but also unnecessary because the truck the Danos bought was aluminium.“So it’s doubtful that rust proofing developed for steel vehicles would even do the trick,” he added.He also noted that clearly the Danos were given a financing arrangement that was suspect.“For a certain percentage of consumers the kind of advertising that promises to put you behind the wheel of a new vehicle is addictive. It’s really hard to pass on and you’re vulnerable in that case unfortunately. And there should be protections,” Iny said.What protections are there for consumers?APTN learned that every province has a complaint-driven process which means no one is watching these deals.“I’m unhappy to tell you that the people who should be protecting you are not,” said Iny. “There are either gaps in the laws on the books or they should be used or could be used creatively.”

The Remedy The Danos still live in Winnipeg and are on the hook for two payments but did get a cash settlement from Birchwood.The dealership did offer a full refund but that was not reasonable nor affordable.“We would have had to pay $21,000 to get out of it which we didn’t have, obviously we didn’t have it,” Tricia Dano said.That amount includes the cash-back amount and also the outstanding balance from the trade-in.“I took the remedy because we needed something. Anything was better than nothing because we’re screwed,” Verne Dano said.Tricia Dano found the process humiliating as well.“[I’ve] been through hell and back dealing with it and then having to go in and be humiliated even. Here’s a cheque but you have to tell your friends that they can’t say anything bad about Birchwood Ford because you know it makes us look bad,” Dano said.Iny said that although affinity marketing may seem more comfortable because of the connection with a certain community, buyers still need to be on guard.“That should give you no solace. You’re not going to get a better deal.”